how to calculate pre tax benefits

Instead of the 4370 that person would have to pay in taxes for making 50000 per year they pay 4130 instead because of the 2000 theyve allotted to pre tax benefits. But thats not always the case.

How To Calculate Pre Tax Definition Formular Example

Calculate the employees gross wages Divide Saras annual salary by the number of times shes paid during the year.

. The results provided are an estimate based on the information provided in the input fields. Just plug in the amount of the loan your current. By offering employees a pre-tax commuter benefit program the cost of commuting deducted for employees reduces the amount of payroll being taxed.

A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover. Between 25000 and 34000 you may have to pay income tax on. Finance costs include the interest paid by the business on the loans taken from the bank.

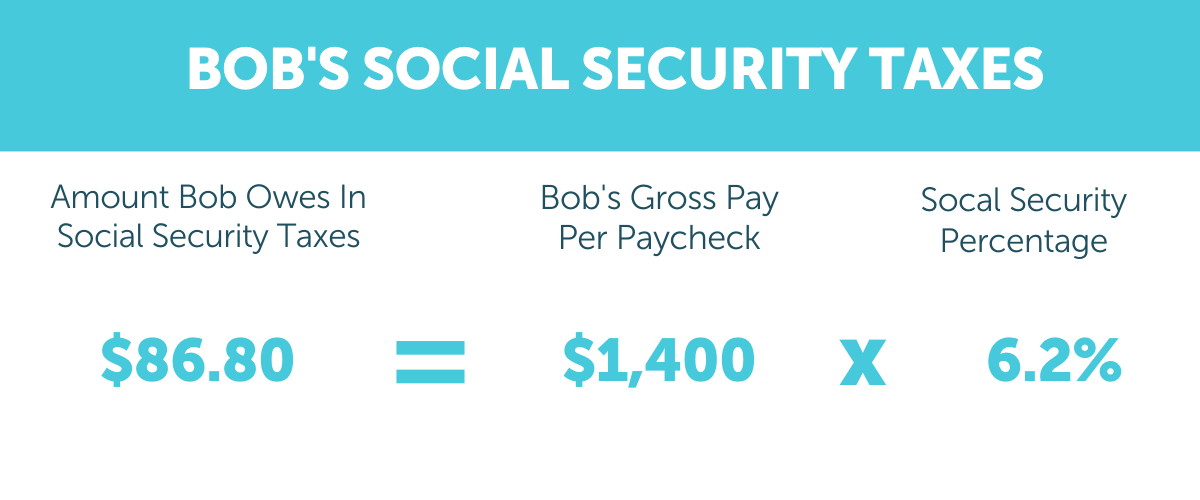

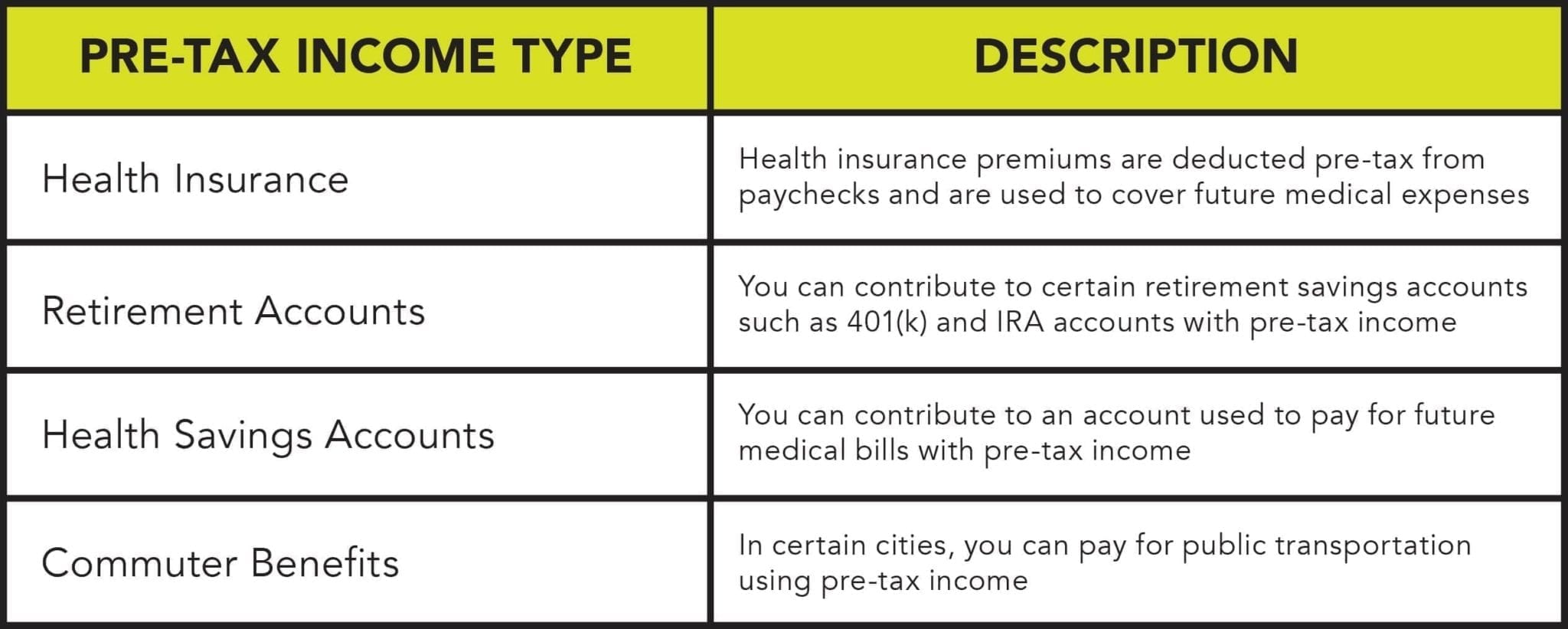

You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover taxes. Generally health insurance plans that an employer deducts from an employees gross pay are pre-tax plans.

To calculate pretax income use the following formulas. Some benefits can be either pre-tax or post-tax such as a pre-tax vs. Pre-tax Income Gross Revenue Operating Depreciation and Interest Expenses Interest Income What is the pre-tax profit margin.

The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period. Note that other pre. Pretax income also known as earnings before tax or pretax earnings is the net income earned by a business before taxes are subtractedaccounted for.

And transportation benefits such as parking and transit fees. Actual Cost Of Pre-Tax Contributions. Choose Your Profile profilename Drag Slider to Estimated Tax Rate.

While shopping for health benefits. This is the formula for calculating pre-tax income. Say you have an employee with a pre-tax deduction.

In this final step deduct the entire. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your taxable income for the year would have been 27000. Actual results may vary.

EBIT Interest Expenses Pretax Income EBITDA Interest Expenses Depreciation Amortization Pretax Income. Her gross pay for the period is 2000 48000 annual. First indicate if you are insuring.

In short with pre-tax benefits the benefit cost is deducted from an employees paycheck before income and. Often the type of deduction you need to make is predefined in the policy for the. The calculator can give you an idea of your expected tax savings for each individual year and for the total time you plan to stay in your home.

HSA Tax Savings Calculator This calculator will show you just how much you are saving in taxes by making contributions to a Health Savings Account HSA. Calculate how much more money you could take home when you use a pre-tax benefit.

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

After Tax 401 K Contributions Retirement Benefits Fidelity

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

After Tax Contributions 2021 Blakely Walters

Pre Tax Income Ebt Formula And Calculator Step By Step

How To Calculate Pre Tax Rate From Post Tax Rate Youtube

Calculate How Much Can You Save With Pre Tax Commuter Benefits For 2020 Personal Finance Data

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Calculating Pre Tax Cost Of Equity In Excel Fm

Pre Tax Income Vs Income After Tax Your Real Pay Clever Girl Finance

Pre Tax Benefits Explained Advantage Administrators

Pre Tax Vs Post Tax Contributions Personal Finance Series Youtube

How Pre Tax Benefits Work How To Save Save Smart Spend Healthy

Pre Tax Vs Post Tax Deductions What S The Difference

Pre Tax Income Ebt Formula And Calculator Step By Step

What Is Post Tax Income Clydebank Media